The holiday season means family, festivities, and charity drives. Charitable nonprofits are viewed as the vehicles through which society can elevate the status quo and achieve “public good.” They come in all shapes and sizes, ranging in purpose from addressing societal needs to supporting extracurricular hobbies to providing trained capuchin monkeys to help those with mobility impairments (yes, this nonprofit does exist). While determining a good cause to donate to is a very individual choice that requires a personal assessment of your values, gauging a nonprofit’s effectiveness is a more empirical process. It feels good to give, but it feels even better to make a difference.

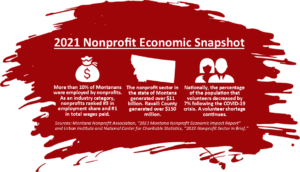

Charity organizations have been characterized as comprising the “third sector” in American industry. In its 2023 “Montana Nonprofit Economic Impact Report,” the Montana Nonprofit Association stated that 10 percent of Montanans were employed by charities in 2021. Nonprofits, as a state industry category, ranked number three in employment share and number one in wage generation for the year, and out of the $11 billion generated by nonprofits in Montana in 2021, a total of $2.6 billion was paid out in wages throughout the state. Ravalli County was listed as home to 352 nonprofits that generate more than $150 million for the year.

Management of public assets demands organizational transparency and accountability. A charity’s wage-payout-to-overall-income ratio is an important number to note when assessing its general “health.” The general rule is that nonprofit administration costs should not exceed 20 or 35 percent of total income. This ensures a greater portion of every dollar you give goes to provide a service or fund the cost of goods. Today, watchdog groups closely monitor nonprofit spending in the United States. Thanks to their efforts, before you give, you can view these assessments and related documents.

Charity Navigator (charitynavigator.org) offers easy-to-understand graphics about local and national charities that make over $1 million. CharityWatch (charitywatch.org) assigns letter grades based on program metrics, fundraising, salary compensation, and transparency. You can also search top-rated charities by category.

For smaller nonprofits, watchdog analysis is not always available. You may need to track down U.S. Internal Revenue Service (IRS) forms 990 or 990-EZ to see how a charity performs. The ProPublica Nonprofit Explorer (projects.propublica.org/nonprofits) is a great source for this type of information. The website summarizes certain data by year and publishes many 990-EZ documents. If you wish to look more deeply into the financials of an organization, the IRS department also keeps a database of domestic tax-exempt organizations at apps.irs.gov/app/eos/. The IRS allows you to search charities in an area or learn more about a specific organization. It publishes 990-series forms, determination letters, and notices showing whether a charity has ever been placed on the IRS Auto-Revocation list for not filing the necessary tax forms for three consecutive years. While these documents are not always conclusive, looking at an organization’s income, expenditures, and assets can reveal a lot. Do employee/CEO salaries and benefits make sense for the services provided? Does the organization receive grants? What percentage of the money received by the nonprofit goes back into the community?

The surest way to ensure your community benefits from a contribution, however, is to donate time instead of money. In a 2023 “Nonprofit Sector in Brief” report published by the Urban Institute and National Center for Charitable Statistics, data indicated that volunteer engagement in the U.S. has decreased by about seven percent since the COVID-19 crisis. Many vacancies remain.

Within the Bitterroot Valley, volunteer opportunities abound. The IRS tax-exempt organization database can double as a research tool to find nonprofits near you. Whether it is playing with dogs in need of forever homes at Bitter Root Humane Association, playing bingo with elderly residents of Discovery Care Center, serving drinks at fundraising events like the Bitterroot Valley Chamber of Commerce’s Bitterroot Brewfest, or hosting a Can the Cats food drive to ensure a Montana Griz victory over their rivals in charitable competition, however you think your civic contributions might be best expressed, there is a means to do so.